FinSA Client information

Based on the legal requirements of Art. 8ff. of the Financial Services Act (FINSA), we would like to supply you with this information sheet which provides an overview of Genève Invest S.à.r.l. (hereinafter referred to as the «financial institution») and its services.

A. Company information

Address

Place Ruth.Bösiger 6

1206 Genève

Phone: +41 (0)22 716 43 50

Email: info.de@geneveinvest.ch

Website: www.geneveinvest.ch

Supervisory authority and audit firm

Under the new Federal Act on Financial Institutions (FinIA), all financial

institutions need a license from FINMA to carry out their professional

activities as a portfolio manager. The financial institution received its

license on 17.02.2024 and is supervised by the supervisory organization

OSFIN. The financial institution is audited in terms of regulatory law by the

auditing company AML Revision AG, and its financial auditing is conducted by

A. Gautier from Société Fiduciaire SA. The addresses of the supervisory

organization and the auditing company can be found below.

OSFIN

Florastrasse 44

8008 Zürich

Phone: 043 488 52 41

Email: info@osfin.ch

Website: www.osfin.ch

AML Revisions AG

Hohlstrasse 560

8048 Zürich

Phone: 044 533 82 00

Email: zuerich@aml-revision.ch

Website: www.aml-revision.ch

A. Gautier, Société Fiduciaire SA

CBI Group

Rue Baylon 2bis

1227 Carouge

Phone: 058 300 72 05

Website: www.cbi.ch

Ombudsman

The financial institution is affiliated with the independent ombudsman OFS, which is recognized by the Federal Department of Finance. Disputes concerning legal claims between the client and the financial services provider should be settled by an ombudsman's office, if possible, within the framework of a mediation procedure. The address of OFS is stated below.

OFS

16 Boulevard des Tranchées

1206 Geneva

Phone: +41 (0)22 808 04 51

Website: www.ombudfinance.ch

B. Information on the offered financial services

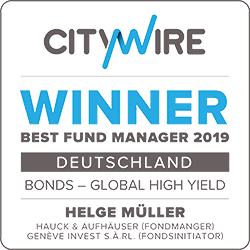

The financial institution provides portfolio management services, portfolio-based and transaction-based investment advisory to its clients. The financial institution also provides financial services in collective investment schemes. For further information on the various collective investment schemes, the general risks, specifications, and operating procedures, please refer to the relevant prospectuses and factsheets on this website.

The financial institution does not guarantee any yield nor performance of investment activities. The investment activity can therefore lead to an appreciation or a depreciation in value.

C. Client segmentation

Financial service providers are required to classify their clients into a client segmentation according to the law and adhere to the respective code-of-conduct. The Financial Services Act provides for «retail clients», «professional clients» and «institutional clients» segments. For each client, a client classification is determined within the framework of the cooperation with the financial institution. Subject to certain conditions, the client may change the client classification by opting out.

D. Information on risks and costs

General risks associated with financial instruments transactions

The investment advisory and portfolio management services involve financial risks. The financial institution shall provide all clients with the «Risks associated with Financial Instruments Transactions» brochure prior to the execution of the contract. This brochure can also be found at www.swissbanking.org.

Clients of the financial institution may contact their client advisor at any time if they have any further questions.

Risks associated with the offered services

For a description of the various risks that may arise from the investment strategy for clients’ assets, please refer to the relevant investment advisory or portfolio management agreements.

Information on costs

A fee is charged for the services rendered, which is usually calculated on the assets under management and/or on a performance basis. For more detailed information, please refer to the relevant investment advisory or portfolio management agreements.

E. Information about relationships with third parties

In connection with the financial services offered by the financial institution, economic ties may exist with third parties. The acceptance of payments from third parties as well as their treatment are regulated in detail and comprehensively in the respective investment advisory and asset management contracts.

F. Information on the market offer considered

The financial institution basically follows an «open universe approach» and tries to make the best possible choice for the client when selecting financial instruments. The financial institution's own collective investments can – where appropriate – be used in the asset management mandates or recommended as part of investment advice.